Every year, Americans file their income tax returns, hoping to receive every legitimate tax break available to them. One way to potentially reduce your tax burden is by filing taxes separately from your spouse, rather than as one joint household. In some cases, the tax numbers work out better when filing separately. But how does that impact your Medicare premiums? Well, it could be a huge mistake! If you’re within 2 years of turning 65 or already Medicare eligible, listen up!

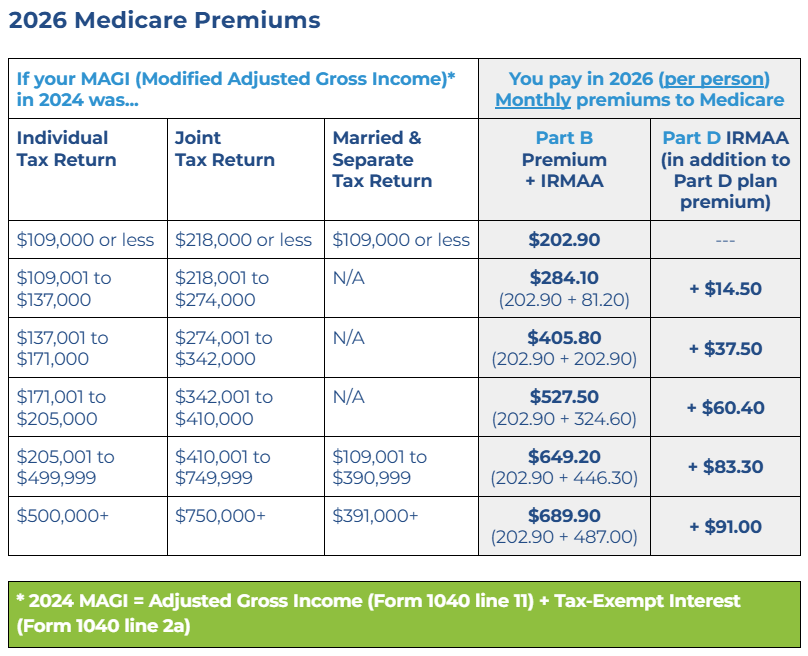

Medicare premiums are based on your adjusted gross income from 2 tax years ago. So in 2026, Medicare automatically looks at your 2024 federal income tax return to determine your Medicare premium. Reference the table below:

As you can see, there are 3 different tax filings Medicare looks at (Individual, Joint, and Married & Separate). You will pay the standard Part B premium of $202.90/mo in 2026, if your individual Modified Adjusted Gross Income (or MAGI) is $109,000 or less...or if your joint MAGI is $218,000 or less.

But what if your accountant or tax software recommends filing separately to save on your income taxes? Should you do it? Well, it depends...

If Your Individual MAGI Is $109,000 or Less

If you and your spouse file separately, this is fine AS LONG AS each of your individual adjusted gross income doesn’t exceed $109,000. You will both pay the standard $202.90/mo Part B premium. All is good here.

If one of you is under $109,000…but the other is above $109,000 — then lower income spouse will pay the standard Part B premium, and the higher income spouse will pay much more.

If your Individual Income Is $109,001 or Higher

But if you go just one dollar over $109,000…you will pay significantly higher Medicare premiums! You will be moved to the 5th or 6th income tier. For instance, the 5th income tier ($109,001-$390,999) yields a $649.20/mo Part B premium, PLUS a high income Part D IRMAA premium of $83.30/mo too! This is a HUGE difference!

How much money would you save by filing your taxes separately? Quite possibly not as much as the increase in your Medicare premiums.

So think twice before filing a separate tax return from your spouse when either of you are within 2 years of turning 65 or already Medicare eligible.

NOTE: This post should not be considered tax advice, rather it’s simply alerting you of how Medicare determines premiums...based on your income and income tax filing status. Consult with a tax advisor for guidance specific to your situation.

Reference Links

www.medicare.gov

Medicare Premiums & Costs

Neither Medicare Mindset LLC nor its agents are connected with the Federal Medicare program.