When you’re turning 65 and getting inundated with advertisements in the mail, it’s easy to get caught up in all the different insurance plan options you have. But this means you might miss some of the basics, like whether your existing health insurance has creditable prescription drug coverage.

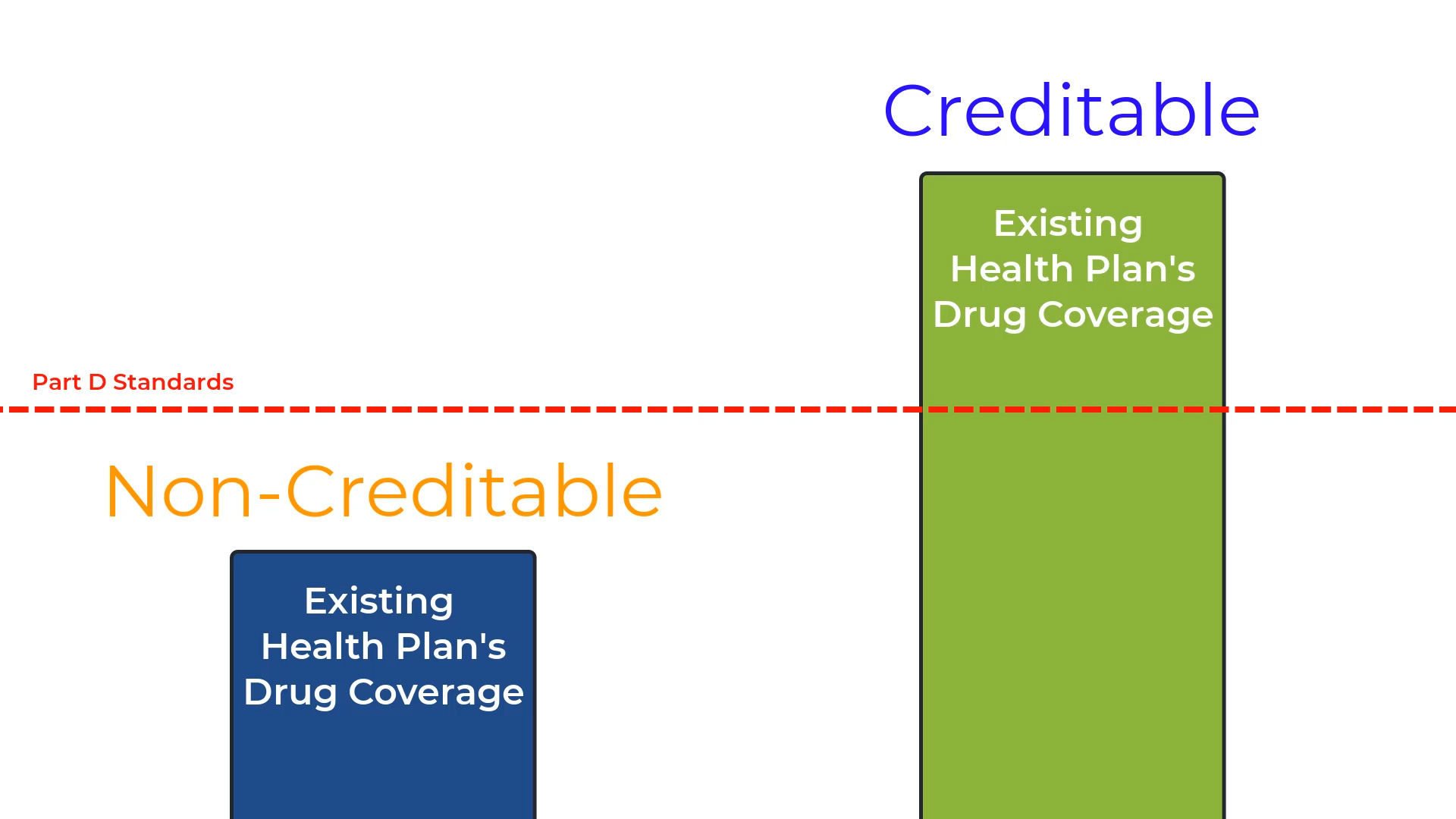

Creditable Prescription Drug Coverage is coverage that is expected to pay out in drug claims as much as the expected drug claims paid under standard Medicare Part D drug benefits.

Creditable prescription drug coverage is completely different than creditable medical coverage. We aren’t disputing your medical coverage. Most commonly, folks are covered under a group health insurance plan through their own employment or their spouse’s. A group health plan will have creditable medical coverage...but it may not have creditable drug coverage. We very often see health plans offered by employers that don’t meet Medicare’s minimum Part D requirements.

So why does this matter?

Well, if you stay on a group health plan and don’t enroll in Part D coverage...and the group plan does NOT have creditable drug coverage...you will begin to accumulate a late enrollment penalty for Part D. And the longer you go without Part D coverage in this instance, the larger your penalty gets! See our blog on this topic: What Is The Medicare Part D Late Enrollment Penalty?

Let’s review 2 scenarios:

Scenario #1 - You Plan To Enroll In Full Medicare Coverage At Age 65

If you intend to enroll in Medicare at age 65 (during your 7-month Initial Enrollment Period) and obtain a stand-alone Part D drug plan or Part D coverage inside a Medicare Advantage (Part C) plan...then you don’t need to worry whether your existing health insurance has creditable drug coverage. Just move forward and you will NOT be penalized.

Scenario #2 - You Plan To Delay All Or Part Of Medicare At Age 65

If you intend to delay Medicare at age 65, you need to confirm whether your existing drug coverage is creditable. Just being covered in a group health plan doesn’t mean you automatically have creditable drug coverage. So you need to verify this with your employer’s human resources department.

If it’s not creditable, then you’ll need to consider enrolling in Part D drug coverage...to avoid the penalty. If it’s creditable, then you can delay Part D without penalty...and purchase it later when you lose your health coverage. When you do purchase drug coverage in the future, you’ll receive a penalty letter. So you’ll need to respond to that letter to remove the penalty. We detail that process in our blog: How To Remove The Part D Late Enrollment Penalty

Here are examples of Creditable Drug coverage to avoid the penalty:

Stand-Alone Part D Drug Plan

Medicare Advantage (Part C) Plan that includes prescription drug coverage

Employer-Sponsored Health Insurance Plan (if you’ve confirmed the drug benefits are creditable)

VA Drug Coverage

TriCare

Indian Health Service

Reference Links

www.medicare.gov

What Is The Medicare Part D Late Enrollment Penalty?

How To Remove The Part D Late Enrollment Penalty

Neither Medicare Mindset LLC nor its agents are connected with the Federal Medicare program.