In a previous post, Medicare & Health Savings Accounts (HSAs), we discussed what an HSA is, how much you can contribute, and how Medicare eligibility affects HSAs. Please read that post to fully understand this post.

VIDEO: When Medicare Part A is Backdated 6 Months

Bottom Line: Medicare Part A is backdated up to 6 months from the month you SUBMIT the enrollment for Medicare and/or Social Security benefits, but Part A won’t start any earlier than your 65th birthday month (or one month sooner if you have a 1st of the month birthday).

See link for details: When Does Medicare Coverage Start?

Let’s review 3 scenarios…one with no backdating, and two with partial or full backdating.

We’ll use our friend, Joe, for these scenarios. Joe’s 65th birthday is April 20th, 2025.

Scenario #1 - Medicare Enrollment Prior to your 65th birthday (NO bACKDATING)

If Joe enrolls in Medicare Part A leading up to his 65th birthday month, Part A will start the 1st of his birthday month (April 1st).

In this case, there is no backdating to be concerned with.

Note: This does not apply if you were already enrolled in Medicare Part A prior to age 65 due to receiving Social Security Disability benefits (SSDI).

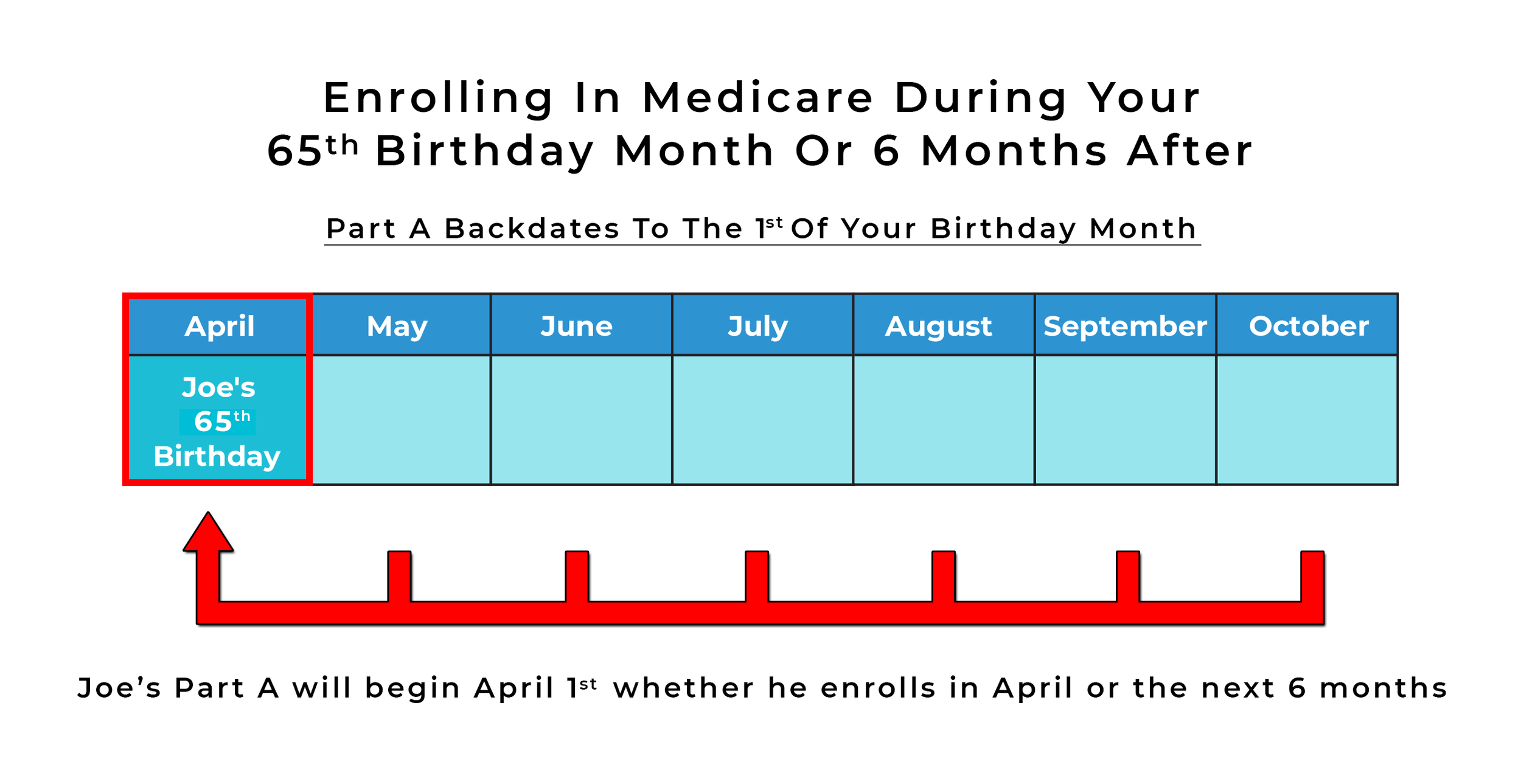

Scenario #2 - Medicare Enrollment in your 65th birthday month…or…the next 6 months

This is where Part A is backdated up to 6 months in the past.

If Joe submits his enrollment for Part A in his 65th birthday month…or any of the 6 months after that, Part A will backdate to the 1st of his birthday month (April 1st). So the backdating is anywhere from 1 to 6 months.

Note: If you (or a spouse) don’t have the necessary 40 quarters (meaning you will pay a Part A monthly premium), then you actually can request Part A to NOT be backdated into the past. This makes sense, as Part A has a very high premium in that situation.

what month is the backdating based on?

Is it the month you submit the application for benefits? Or is it the month you want your other benefits to begin (Part B and/or Social Security benefits?

Part A backdating is based on the month you SUBMIT your application for benefits. Count back from that month, NOT the month you’re requesting Part B and/or Social Security benefits to begin.

Let’s use Scenario #3 below to visually show how this works…

Scenario #3 - Medicare Enrollment MORE than 6 months after your 65th birthday month

Let’s say Joe never enrolled in any Medicare when he turned 65, because he was working for a large employer with 20+ employees and contributing to a Health Savings Account (HSA). But now he plans to go on Medicare and Social Security retirement benefits in April 2027…when he turns 67.

Typically, we would recommend that Joe submit his application for benefits about 3 months prior to when he wants them to start. So if he wants an April 2027 start date, then he would SUBMIT the application in January 2027. It can take some time for the Social Security Administration (SSA) to process the application for benefits, so submitting about 3 months prior is prudent.

But as mentioned above, the Part A backdating is based on the month the application is SUBMITTED. So that means Part A will backdate 6 months from January 2027…all the way back to July 2026!!

Why is this a problem?

Well, it negatively impacts Joe’s ability to contribute to his HSA account. Since his Medicare Part A was backdated to July 2026, he really was only eligible to contribute to his HSA account for 6 out of 12 months in 2026. That enables him to contribute 6/12’s (or 1/2) of the normal HSA contribution limit (including 1/2 of the $1,000 catch-up contribution).

So if you’re enrolling in Medicare only, Social Security only, or both Medicare and Social Security for the first time…and you’re more than 6 months beyond your 65th birthday month…your Part A will be backdated a full 6 months from the month you SUBMIT your enrollment for benefits.

Plan ahead so you don’t overcontribute to your HSA account and create tax issues. See our prior blog post on how it impacts your taxes (Medicare & Health Savings Accounts).