VIDEO: 2026 Medicare Part D: How It Works + 10 Discounted Drugs

2026 Medicare Part D prescription drug coverage is very similar to 2025, but with a new twist:

10 high cost drugs have been negotiated down in price by Medicare. These include:

Eliquis

Xarelto

Jardiance

Januvia

Enbrel

Entresto

Farxiga

Stelara

Imbruvica

Fiasp and Novolog

This means you should see lower overall costs for these medications in 2026.

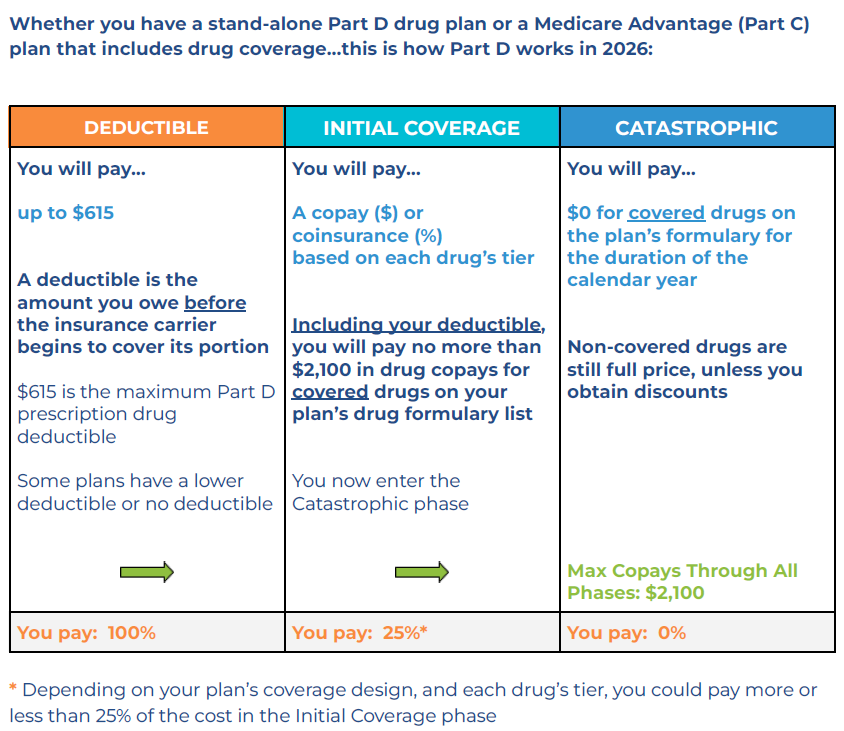

There will be a cap on your prescription costs ($2,100). *

Watch our video on how this works, or read the next section below.

* NOTE: Only COVERED medications on your plan’s formulary list of drugs are counted toward the $2,100 cap.

2026 Medicare Part D Prescription Drug Coverage

Let’s Review Each Of The 3 Phases. As You Read The Descriptions, Reference The Visual Above...

Deductible

This is the period where you must pay a certain amount of prescription costs before your Part D plan kicks in. The maximum deductible a Part D plan can have is announced each year by Medicare. In 2026, the maximum deductible is $615. That doesn’t mean it’s the maximum you’ll pay all year, rather it’s what you owe initially before your plan begins to help pay a portion of your drug costs. Some Part D plans have the full $615 deductible, some have a lower deductible, and some don’t have a deductible at all.

Initial Coverage

Assuming your medications are on your plan’s formulary list of drugs, this is when your Part D plan begins to pay the bulk of a drug’s cost. It’s “Tier-based” pricing. Typically, generic drugs are Tier 1 or Tier 2...and then, brand name drugs are Tier 3, Tier 4, and specialty drugs are Tier 5. You will pay tier-based pricing until you reach the cap of $2,100 (including your deductible)…which means you’ve reached the Catastrophic phase.

Catastrophic

As indicated, once you reach $2,100 in copays (including your deductible), you no longer pay any copays for COVERED drugs on your plan’s formulary list of medications.

Reference Links

www.medicare.gov