Medicare High Income IRMAA Premium Appeal/Reconsideration Process (2026)

Watch this video first! It explains the whole process. Detailed instructions are below.

If you received an Initial IRMAA Determination Letter stating your Medicare premiums will be increased, due to high income in the past…now is the time to file the appeal / request for reconsideration through the Social Security Administration.

Despite the letter saying you have 10 days, you typically have about 60 days to submit the appeal paperwork. But the sooner the better, as you will be charged the high income premiums in the meantime.

You must have a reduction of adjusted gross income…AND…a relatively recent Life Changing Event in order to submit the appeal.

If you had a big IRA withdrawal or capital gain two years ago, but did NOT have one of the 8 Life Changing Events listed further down the page…then an appeal will be unsuccessful.

The timing of the income reduction needs to at least somewhat correspond with the a Life Changing Event (i.e. retirement in the past 1-3 years).

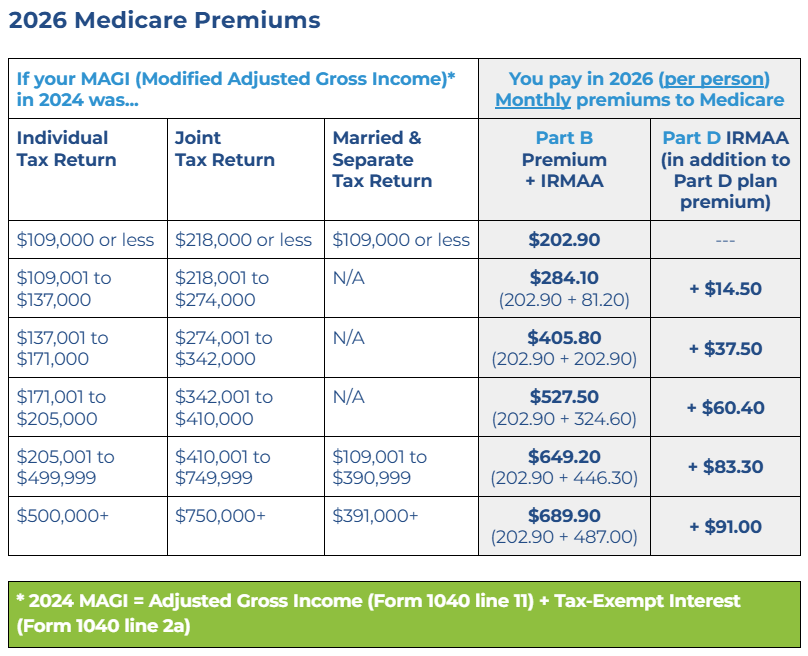

Also, the income reduction must be large enough to get you into a lower income range than shown on your tax return in 2024. If your income reduced in 2025 or 2026, but you still end up in the same income range as shown on your 2024 tax return…then an appeal won’t help you.

See the premiums and income ranges below…

NOTE: DO NOT submit the appeal until you’ve received your IRMAA Determination Letter stating you are subject to IRMAA

Life Changing Events

There are 8 possible events to choose…

Marriage

Divorce/Annulment

Death of Your Spouse

Work Stoppage

Work Reduction

Loss of Income-Producing Property

Loss of Pension Income

Employer Settlement Payment

Work Stoppage and Work Reduction are the most common.

Loss of Income-Producing Property and Employer Settlement Payment are not what you think. Read the description for each event on the form (download the form via the orange button in the “How to Complete Form SSA-44” section below).

Supporting Documents

Life Changing Event — Include the necessary information to support the event. A few examples…

Work Stoppage or Work Reduction: A letter from your former employer detailing the change in status (i.e. retirement, change to part-time). If this isn’t possible, then write up a brief letter of instruction explaining the situation. You can also include information on the income reduction, as we mention in the Income Reduction bullet point below.

Death of Your Spouse: A copy of the death certificate

Income Reduction — You really aren’t required to provide proof of the reduced income IF you’re using an estimate of income for a year you haven’t filed a tax return. But it doesn’t hurt to quickly summarize your estimated income. A few examples…

A self-created spreadsheet or letter of instruction summarizing the income sources and amounts. Keep it simple.

W2, paystub, 1099, federal tax return (These would only be needed if you were referencing a tax year in which you already had this information. Otherwise, breakdown your estimated income on a spreadsheet or letter of instruction.)

How to Complete Form SSA-44

Click the button below to download and open the form

EACH person needs to complete their own Form SSA-44.

DO NOT submit the paperwork until you’ve received your IRMAA Determination Letter stating you are subject to IRMAA.

Page 1

Enter your name and SSN.

Page 2

Step 1:

Choose your Life Changing Event and add the date the event happened.

Step 2:

Enter the tax year in which your income decreased because of the life changing event, as well as your best estimate of what your adjusted gross income and tax-exempt interest will amount to. Select the tax filing status you anticipate using for this particular tax year.

If both 2025 and 2026 are going to be in the same income range, choose either year…It won’t matter. However, if you have your 2025 tax return completed, then include a copy of your return with the IRMAA paperwork…again, assuming 2025 and 2026 are in the same income range.

If one of the years is in a lower income range than the other, choose the year that is lower…and provide supporting documentation.

Step 3 (not needed):

We recommend choosing NO in this step. If your income will be in an even lower income range than the year listed in Step 2, you’ll still need to appeal again the following year. So there’s no real benefit to answering Yes.

Page 3

Add your signature and address.

Submit to Your Local Social Security Office or Upload in your SSA Online Account

Use the Social Security Office Locator to confirm which office is assigned to your zip code.

Make a copy of the paperwork and supporting documents for your records.

Then submit everything to the local Social Security office. You can turn in the paperwork in the SSA office’s drop box, mail it, or fax it. As of Jan 2025, “walk-ins” are no longer allowed for this type of situation.

If you and your spouse are both appealing at the same time, send your sets of paperwork together in the same envelope…that way, the same SSA rep handles your requests.

After you submit, Social Security will process your appeal and update you on their decision by mail. If you don’t hear anything after 30-45 days, contact the Social Security office and kindly ask for an update.

Or if you prefer, you can upload the documents in your online SSA.gov account.

If Social Security Doesn’t Process This Correctly or Gives You Problems…

If you’re a client of our agency, get us involved when you’re getting a lot of pushback from Social Security, or something seems wrong. Occasionally, SSA reps don’t follow their listed procedures and we need to remind them of the rules.

For example, some SSA reps sometimes say you can’t use an income ESTIMATE on these appeals. Well, that is simply wrong. It specifically states you can use an income estimate on Form SSA-44 and in their procedures (see this link: https://secure.ssa.gov/poms.nsf/lnx/0601120005).

It makes sense to allow the use of an income estimate because you might not have filed your prior year’s tax returns at the time you are transitioning to Medicare. Additionally, if you just retired and income will drop because of it, then the only way an appeal makes sense is to provide an estimate of income for an upcoming year. Showing them past income when you were working full time will usually not help your cause.