Click each part of Medicare to learn more.

Original Medicare

-

Learn More

Learn MorePart A (hospital)

In general, Part A covers (allows):- inpatient hospital care

- skilled nursing facility care

- nursing home care (in certain situations)

- hospice care

- home health services

-

Learn More

Learn MorePart B (Medical)

Part B covers medically necessary services and preventive services on an outpatient basis. This includes, but is not limited to…- visits to your primary care doctor or a specialist

- medical treatments and tests

- laboratory testing

- durable medical equipment (DME)

- outpatient surgery

- outpatient prescription drugs (in limited situations)

- mental health services

- ambulance services

Learn More

Medigap

Medigap health insurance plans are used to help pay for some of the healthcare services covered/allowed by Medicare but not fully paid for. In other words, it helps fill some of the gaps of Original Medicare coverage.

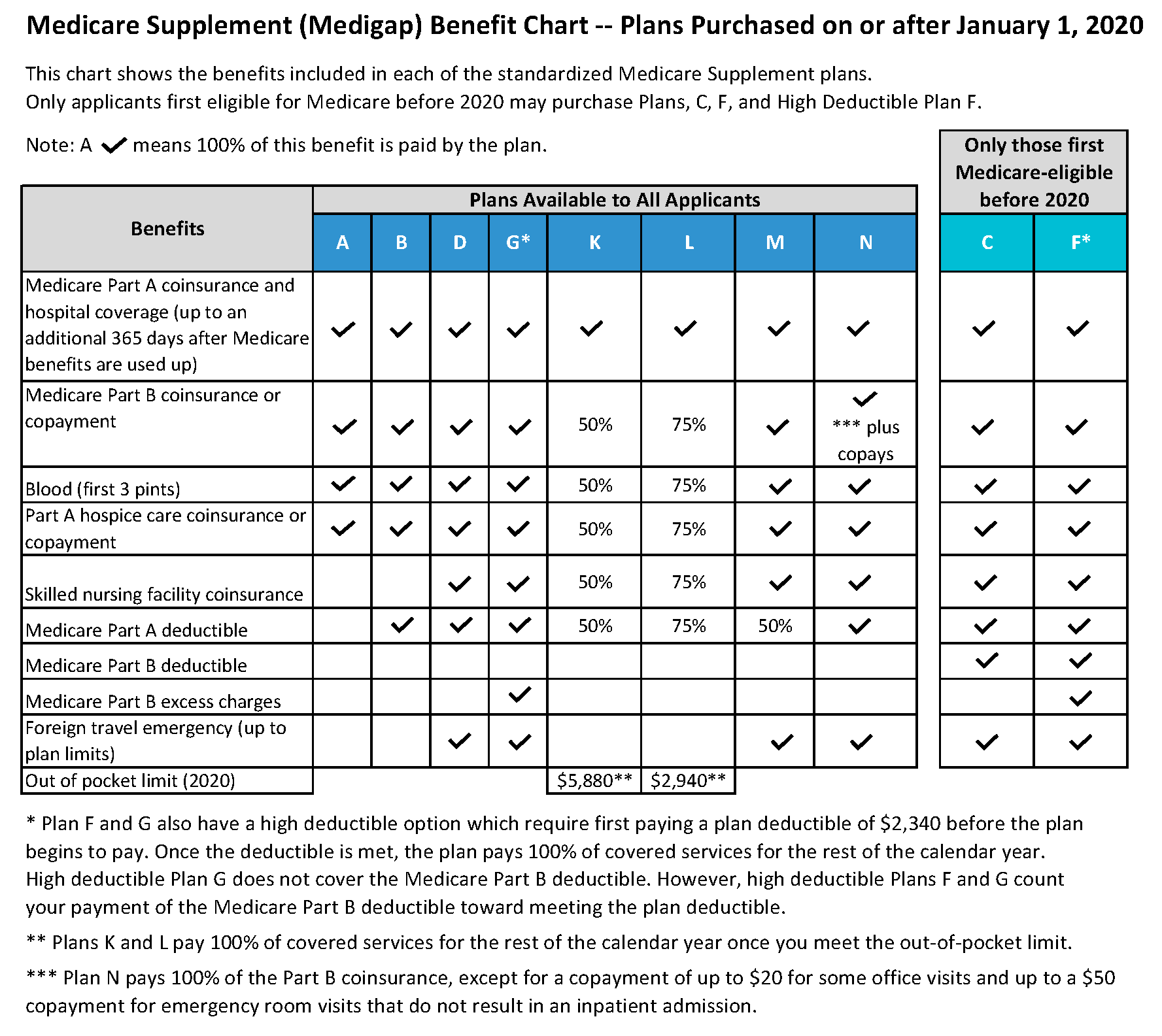

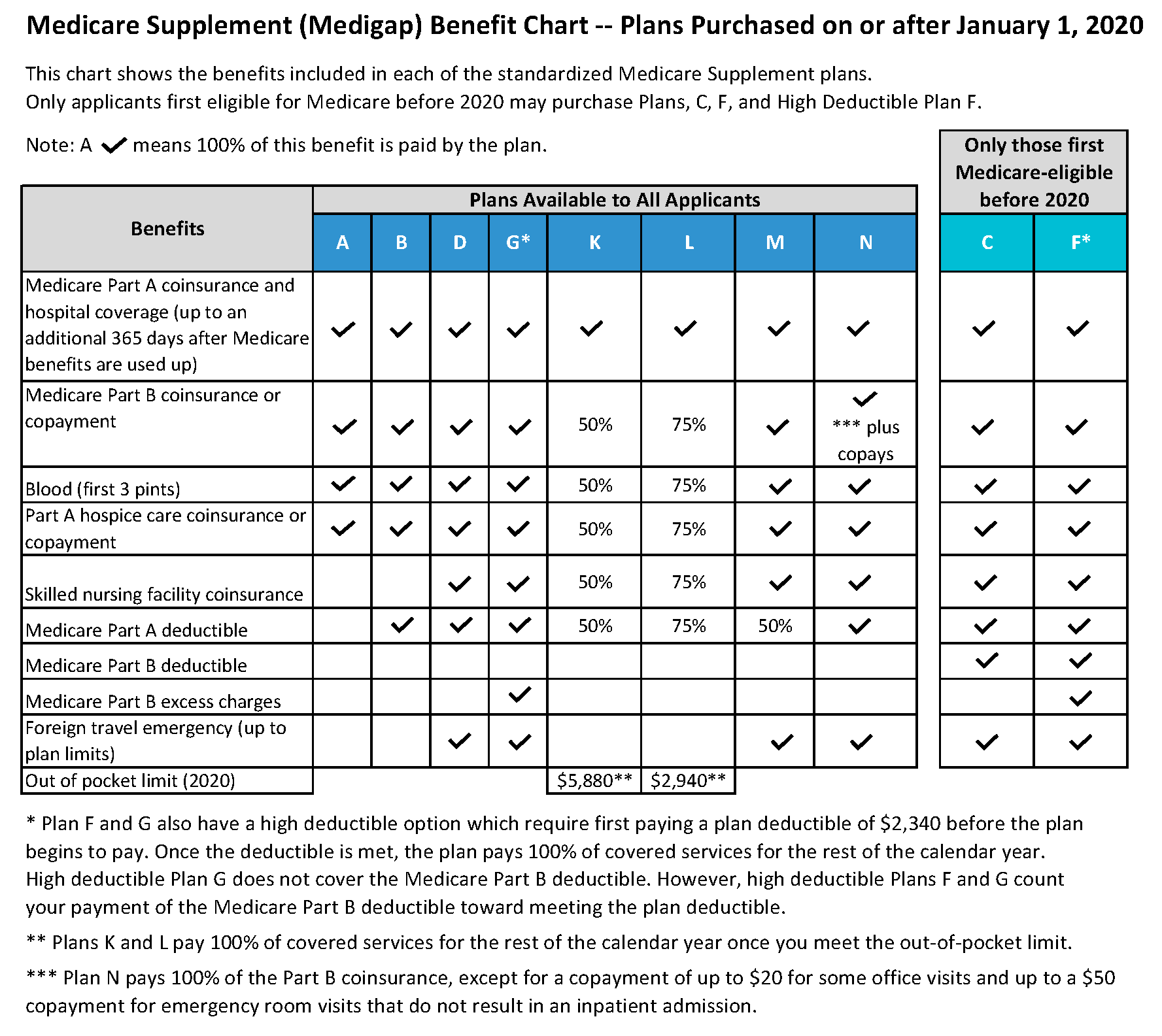

There are several Medigap plans to choose from. Unfortunately, the plans are lettered, so it can be confusing when you see Medigap plans with the same plan letter as the parts of Medicare we have summarized above.

There are several Medigap plans to choose from. Unfortunately, the plans are lettered, so it can be confusing when you see Medigap plans with the same plan letter as the parts of Medicare we have summarized above.

Learn More

Part D (prescription drug)

Medicare Part D plans were first made available in 2006. They provide coverage for prescription drugs purchased in a pharmacy setting (or via mail order). A Part D prescription drug plan does not pay for 100% of your prescription costs, rather it pays a portion (if the drug is on the Part D prescription drug plan’s formulary). A cost-share is involved, so you will still owe a copay when picking up your prescriptions.

Coverage and drug copays are primarily based on a drug’s tier (usually Tiers 1 through 5). A drug in a lower tier will generally cost less than a higher tier drug.

There are also different phases of Part D, so your drug copays can change throughout the calendar year, depending on which phase you are in. Essentially, the more expensive your prescriptions cost on a gross basis, the more likely you will reach the different phases of Part D. The four phases of Part D include:

Coverage and drug copays are primarily based on a drug’s tier (usually Tiers 1 through 5). A drug in a lower tier will generally cost less than a higher tier drug.

There are also different phases of Part D, so your drug copays can change throughout the calendar year, depending on which phase you are in. Essentially, the more expensive your prescriptions cost on a gross basis, the more likely you will reach the different phases of Part D. The four phases of Part D include:

- Deductible Phase: This is the period where you must pay a certain amount of prescription costs before your Part D plan kicks in. The maximum deductible a Part D plan can have is announced each year by Medicare. Your Part D prescription drug plan can choose to use the maximum deductible, have a lower deductible, or no deductible at all.

- Initial Coverage Phase: This is when your Part D plan picks up the bulk of the cost (about 75% or more).

- Coverage Gap (Donut Hole): Once your gross drug costs reach a certain amount, you will enter what has been coined the Donut Hole. You typically owe a higher percentage of a drug’s costs in this phase at most 25% of the drug's gross cost.

- Catastrophic: If your drug costs are high enough, you will reach this phase. This is where you pay no more than 5% of the cost of the drug the rest of the calendar year. And then everything resets on January 1st…placing you back in the deductible phase.

or

Medicare Advantage

-

Learn More

Learn MorePart A (hospital)

In general, Part A covers (allows):- inpatient hospital care

- skilled nursing facility care

- nursing home care (in certain situations)

- hospice care

- home health services

-

Learn More

Learn MorePart B (Medical)

Part B covers medically necessary services and preventive services on an outpatient basis. This includes, but is not limited to…- visits to your primary care doctor or a specialist

- medical treatments and tests

- laboratory testing

- durable medical equipment (DME)

- outpatient surgery

- outpatient prescription drugs (in limited situations)

- mental health services

- ambulance services

Learn More

Part C (Medicare Advantage)

Part C is another name for what most people call a Medicare Advantage Plan. Rather than running medical claims through Medicare first and then a Medigap (Medicare Supplement) plan…and then purchasing a stand-alone Part D prescription drug plan, you would use the Medicare Advantage plan to file all medical and prescription drug claims. You don’t need your Original Medicare card in this case (just file it away in a safe place).

Part C (Medicare Advantage) plans typically combine Parts A, B and D in one plan…though, some Medicare Advantage plans are available without Part D prescription drug coverage (i.e. when you already have creditable prescription drug coverage through another source, such as the VA).

Part C (Medicare Advantage) plans typically combine Parts A, B and D in one plan…though, some Medicare Advantage plans are available without Part D prescription drug coverage (i.e. when you already have creditable prescription drug coverage through another source, such as the VA).